Navigate Change: Shaping Smarter Finance Together

Huawei has been serving the financial industry for 13 years. With the support of our customers and partners, we have weathered every storm together. Now, Huawei has become a trusted technology partner in the global financial industry.

To date, we have served over 3,300 financial customers in more than 60 countries and regions, including 50 of the world’s top 100 banks. We are proud to have secured the top spot in China’s financial cloud and infrastructure market, and have collaborated with over 150 industry solution partners worldwide to provide unparalleled service to our customers.

But none of this would have been possible without the unwavering support of each and every one of our customers and partners, and we express our heartfelt gratitude to you all.

AI has surpassed the inflection point and is now leading the transformation of fintech and services

The world is rapidly approaching a milestone of 100 billion connections, with an explosion of data at the ZB level. We have officially entered the era of ZFLOPS, where the power of AI has surpassed the inflection point and is now driving transformation across various industries and services. But to thrive in the intelligent era, we must re-evaluate our approach to connections, data, applications, and infrastructure, and fully embrace digital technologies to build future-oriented core competitiveness.

- Strengthening the resilience of digital infrastructure and distributed engineering reliability to support always-on services

- Refactoring applications based on cloud-native architecture to accelerate service agility

- Improving data governance to build real-time converged data capabilities and boost intelligent decisions

- Establishing all-scenario connections to improve customer experience and innovate business models

These tasks not only serve as “homework” for the financial industry, but also provide direction for Huawei to contemplate and act upon.

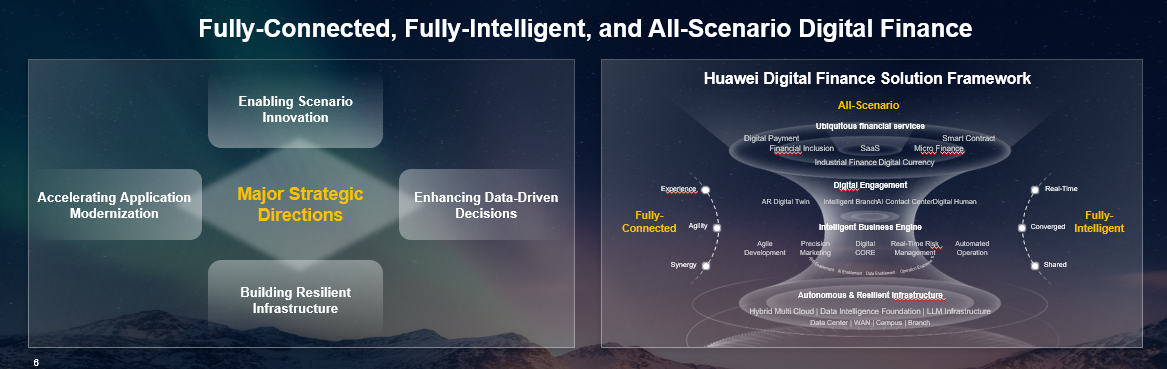

Last year, Huawei established the Digital Finance business unit to collaborate with customers and partners in the financial industry. Our strategic focus has four major directions:

- Building resilient infrastructure

- Accelerating application modernization

- Enhancing data-driven decisions

- Enabling scenario innovation.

To achieve this, we have developed four-layer solutions to help customers build full connectivity featuring agility, experience, and collaboration, as well as achieve full intelligence that is real-time, converged, and shared, thus enabling ubiquitous all-scenario financial services.

Four strategic directions for building fully-connected, fully-intelligent, and all-scenario digital finance

Building resilient infrastructure

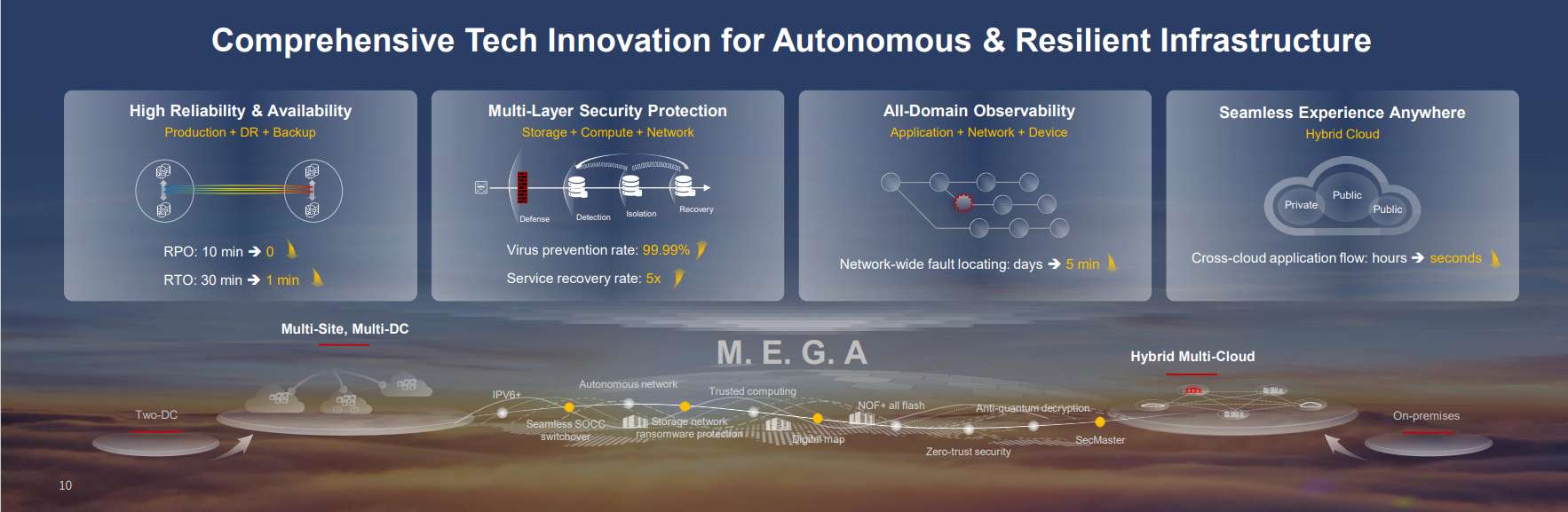

The trend towards ubiquitous always-on financial services presents diverse challenges to IT infrastructure. With a focus on user experience, business resilience, and application security, Huawei is dedicated to building MEGA infrastructure and supporting evolution from mainframes to cloud-native container cloud architecture.

We use the concept of Multi-DC-as-a-Computer and the peer-to-peer computing of CPUs, GPUs, and NPUs to enable the multi-active data center to run efficiently, just like a computer, and deliver end-to-end experience. In the case of accelerated expansion of distributed computing power, we use new architectures, materials, and algorithms to support green and low-carbon infrastructure. Finally, we achieve autonomous operations in distributed mode, and adopt AIOps capabilities such as digital maps to improve O&M efficiency.

Based on the concept of MEGA, we build autonomous and resilient financial infrastructure through comprehensive technological innovation. For example, our infrastructure supports multi-site multi-active disaster recovery with an RTO of less than 1 minute and zero RPO, ensuring high service availability. We provide security protection at the storage, compute, and network layers for five times more efficient proactive ransomware protection, real-time detection, and service recovery. Additionally, we offer a seamless experience on hybrid multi-cloud with cloud-native capabilities, enabling application mobility in seconds.

At the summit, we released the innovative technical capabilities of our latest ICT products and portfolios to help the financial industry build autonomous and resilient infrastructure.

Accelerating application modernization

The ‘platform + service’ model is crucial for enhancing the business agility of finance, and modernizing financial applications is the only viable approach. We believe that financial application modernization requires six key elements: service-oriented architecture, high and low code integration, security compliance, multi-active resilience, composable delivery, and AI/data-driven technology.

Drawing on Huawei’s extensive experience in core system and application modernization, we have developed a comprehensive suite of engineering methods and tools, and have successfully applied this valuable expertise to the application modernization process for our financial customers.

We have been heavily involved in core architecture transformation, and have systematically upgraded our capabilities in four phases: planning and design, platform construction, service rollout, and O&M. In addition to providing products and platforms, we also offer our customers engineering methods, tool chains, planning and design, and comprehensive services. We also achieve collaborative network optimization with our partners. During the evolution to the digital CORE systems, we focus on unlocking the full potential of all services. Our V-model-driven design, Lego-style development, unit-based running, integrated O&M, and multi-cloud and multi-active deployment can help customers deliver business value through core system upgrades.

Globally, Huawei has provided application modernization and core system upgrade services to over 150 customers, including the People’s Bank of China, as well as other large banks, urban commercial banks, rural credit unions, and numerous financial institutions worldwide. Today, we are proud to announce the release of the Digital CORE Solution 3.0, which features six upgraded capabilities and joint solutions for four scenarios. This solution enables our customers to accelerate the modernization of their applications across all services throughout the entire journey.

Enhancing data-driven decisions

The financial industry has accumulated vast amounts of data. Huawei believes that to unleash the value of this data, the industry needs to take four leaps: from operation to data, from data to information, from information to knowledge, and from knowledge to action. These four leaps require upgrades in data architecture, data governance, data consumption, data security, and data talent.

Take data consumption as an example. It’s essential to change the traditional passive way of supplying data. To do this, we need to build a centralized data service platform that enables proactive data supply, in which data can be subscribed to, allowing the staff of both banks’ head offices and branches to use data.

We hope that one day all financial data is easy to use and can create value. Huawei has been taking key measures to achieve this goal. We are building leading architectures, enhancing efficiency, enabling scenarios, and delivering outstanding services. Today, we will release the Data Intelligence Solution 3.0, which is upgraded with cloud-native data architecture, data governance, technology-enabled services, and more.

Based on the real-time data lakehouse, it responds to data requests within seconds. And by building distributed cluster computing, it supports large models with hundreds of billions of parameters and TB-level efficient data training. The solution converges data and AI workflows for one-stop data development and modeling, enabling model development in weeks instead of months. By fully integrating cloud, data, intelligence, and computing, the solution allows everyone in the financial industry to use data and it enables universal intelligence.

Huawei’s Data Intelligence Solution serves over 100 financial institutions globally, with two-thirds of China’s top 20 banks having chosen Huawei to build their data and AI platforms.

Enabling scenario innovation

All industries are accelerating digitalization, and industrial finance has also entered the era of industrial digital finance 3.0.

Huawei dives deep into industrial finance by mapping technology to different scenarios. Innovative technologies are closely combined with scenarios, so that finance can enable various industries. This can be clearly seen in the transformation from subject credit to subject and transaction credit. In the inventory financing domain, China has over 100 trillion yuan (approx. US$13.959 trillion) of inventories, 90% of which are not well used for financing due to a lack of technologies. In this space, Huawei is looking to develop desirable technologies together with technical and industry partners.

Centering on scenarios like cold chain, bulk commodity, dry bulk, and common products, we have solved many difficulties in real-time asset control by consolidating the capabilities of Huawei’s product lines and 2012 Labs. We have combined diverse cutting-edge technologies to build a Device-Edge-Cloud-AI Industrial Finance Platform, achieving trustworthiness from three dimensions: trusted supervision, trusted ownership, and value from trust.

First, “trusted supervision” is the basis. We have innovated together with Shanghai Pudong Development Bank. Relying on the edge intelligence digital twin and Pangu CV model, we can ensure all goods are traceable through trusted supervision. Our joint work has supported the promotion of SPDB Finwarehouse.

Second, “trusted ownership” provides a guarantee. We use a multi-party co-governance alliance chain to store and trace certificates for inventories, ensuring clear ownership. Huawei and Qianhai Mercantile Exchange have co-built such an alliance chain and the digital warehouse receipt 3.0.

Finally, “value from trust” is the goal. We deeply cooperate with ecosystem partners, such as CITIC Phoneix Harbor, to make it a reality.

At this summit, Huawei has released the latest Inventory Financing Solution and Industrial Finance Co-Innovation Program, both from the result of Huawei’s exploration in the industrial finance domain. We invite partners from all industries to join us.

Collaborating to Develop Digital Talent for the Financial Industry

An industry flourishes only when it engages professionals. As such, developing digital talent is crucial for the financial industry. Over the past three years, we have developed over 15,000 digital professionals jointly with customers. In the next three years, we hope to collaborate more closely with customers, industry associations, and partners to bring this number to 50,000. Together, let’s create more success stories by providing the financial industry with more digital professionals.

Moving forward, Huawei remains committed to advancing cutting-edge technologies and exploring new scenarios, while at the same time collaborating with customers and partners to build fully-connected, fully-intelligent, and all-scenario digital finance. By navigating changes with agility and innovation, we aim to enhance digital productivity and create a brighter future together.

Learn more about Huawei’s Intelligent Finance solutions.

Disclaimer: Any views and/or opinions expressed in this post by individual authors or contributors are their personal views and/or opinions and do not necessarily reflect the views and/or opinions of Huawei Technologies.

Leave a Comment