Gigabite Index 2025: How Telcos Softened the Cost of Living Crisis

One of the major economic issues of recent times was the surge in inflation to multidecade highs across many countries, largely as a result of supply-side constraints and boosts to domestic demand caused by the pandemic.

While the International Monetary Fund note in their recent update to their World Economic Outlook that inflation has now fallen back, prices in general for many consumer staples have remained greatly elevated. Statista, for example, illustrate that between February 2020 and July 2024, average transportation costs had increased by 27.1% for US consumers. Those for foods and beverages by 25.2%. Similar increased costs across many countries for the basics of life hit poorer households especially hard, creating a global cost of living crisis.

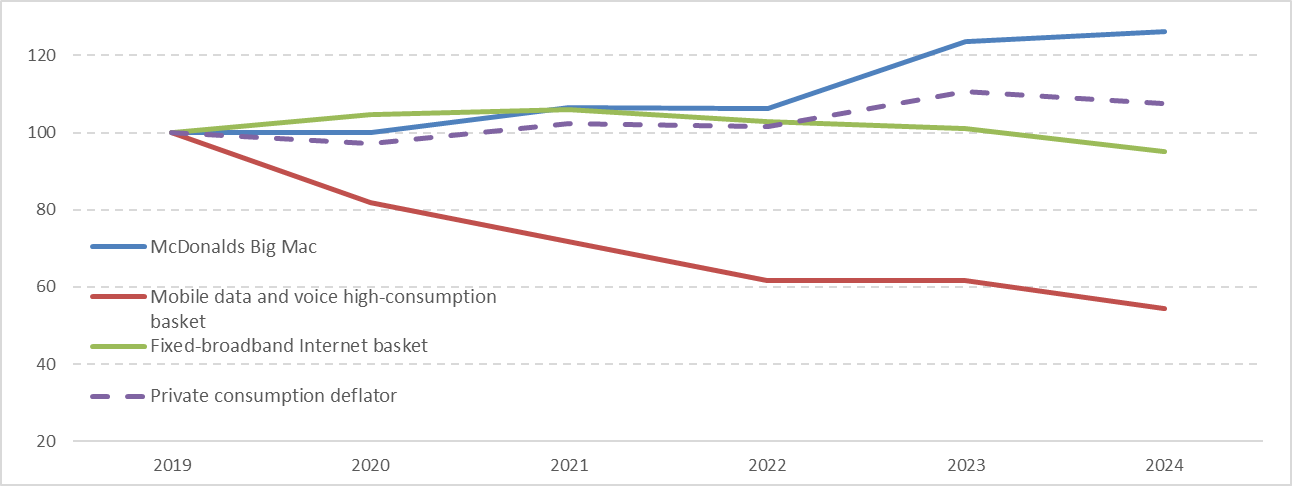

Chart 1 – Comparing the rise in dollar prices across 30 major developed and developing countries

Source: Huawei calculations based on data from ITU, The Economist and IMF

Most people would agree that internet connectivity through mobile and fixed broadband has also become a daily essential. How then have mobile and fixed monthly broadband plan prices changed since 2019?

Chart one illustrates the average US$ price across 30 major developed and developing countries from 2019 to 2024 (2019 = 100) for four items. A McDonalds’ Big Mac; a high-consumption mobile data and voice plan; a fixed-broadband internet plan; and the overall private consumption basket of goods and services.

A Big Mac was on average 26% costlier in dollar terms across my sample of 30 countries in 2024 compared with 2019 (pre-pandemic), according to data supplied by The Economist. This chimes with other estimates for the general rise in the cost of living. But a less well reported story has been the fall in costs of mobile and fixed plans across many countries. According to International Telecommunications Union data (who impose standardisation across measured connectivity plans), average US$ prices for fixed broadband plans actually fell by around 5% and those for high-consumption mobile data and call plans by a staggering 45%!

In a previous article, I outlined the problems in comparing consumer digital connectivity plans across countries. As a proportion of household income, Internet connectivity costs are generally much lower in richer countries than in poorer ones. Exchange rate movements against the dollar cause individual distortions if we use that as a common currency unit.

As a result I suggested an alternative calculation that would be simpler than purchasing power parities and GDP adjustments and hopefully more consistent (and intuitive) across countries. That was to exchange domestically produced Big Macs for local mobile and fixed internet connectivity. Basically, a proxy of the required trade-off in any given country between prepared food and telecommunications. This resulted in the Gigabite Index.

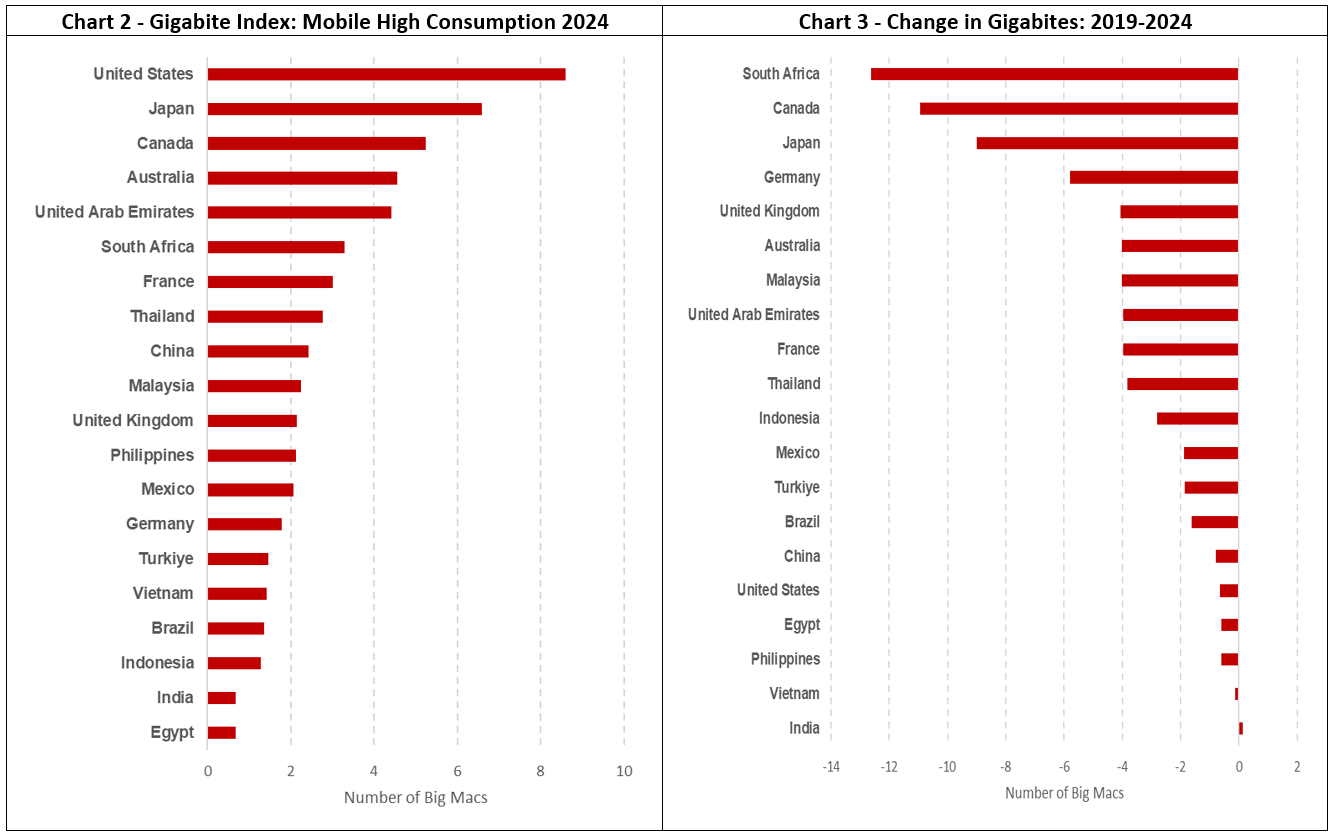

Source: Huawei calculations based on data from the ITU and The Economist

Chart two shows the update of the Gigabite Index for a monthly high-consumption mobile data and voice plan. According to ITU and The Economist data, the United States requires the highest number of Big Macs foregone to afford a typical mobile voice and data plan, at a large family take-out of 8.6 Big Macs. Egypt requires the least in 2024, at just two-thirds of one Big Mac. It is notable that the major European countries in the group are substantially cheaper (require far fewer Gigabites) in 2024 than North America.

The better news is that the amount of Big Macs required to be traded has fallen across almost all countries between 2019 and 2024 (chart three). In Germany, you need to forgo 5.8 fewer Big Macs to afford a high-consumption mobile voice and data plan in 2024 than you did in 2019. Despite its notoriously high inflation, you needed almost two fewer Big Macs in Turkiye in 2024 than you did in 2019 for your monthly mobile smartphone plan.

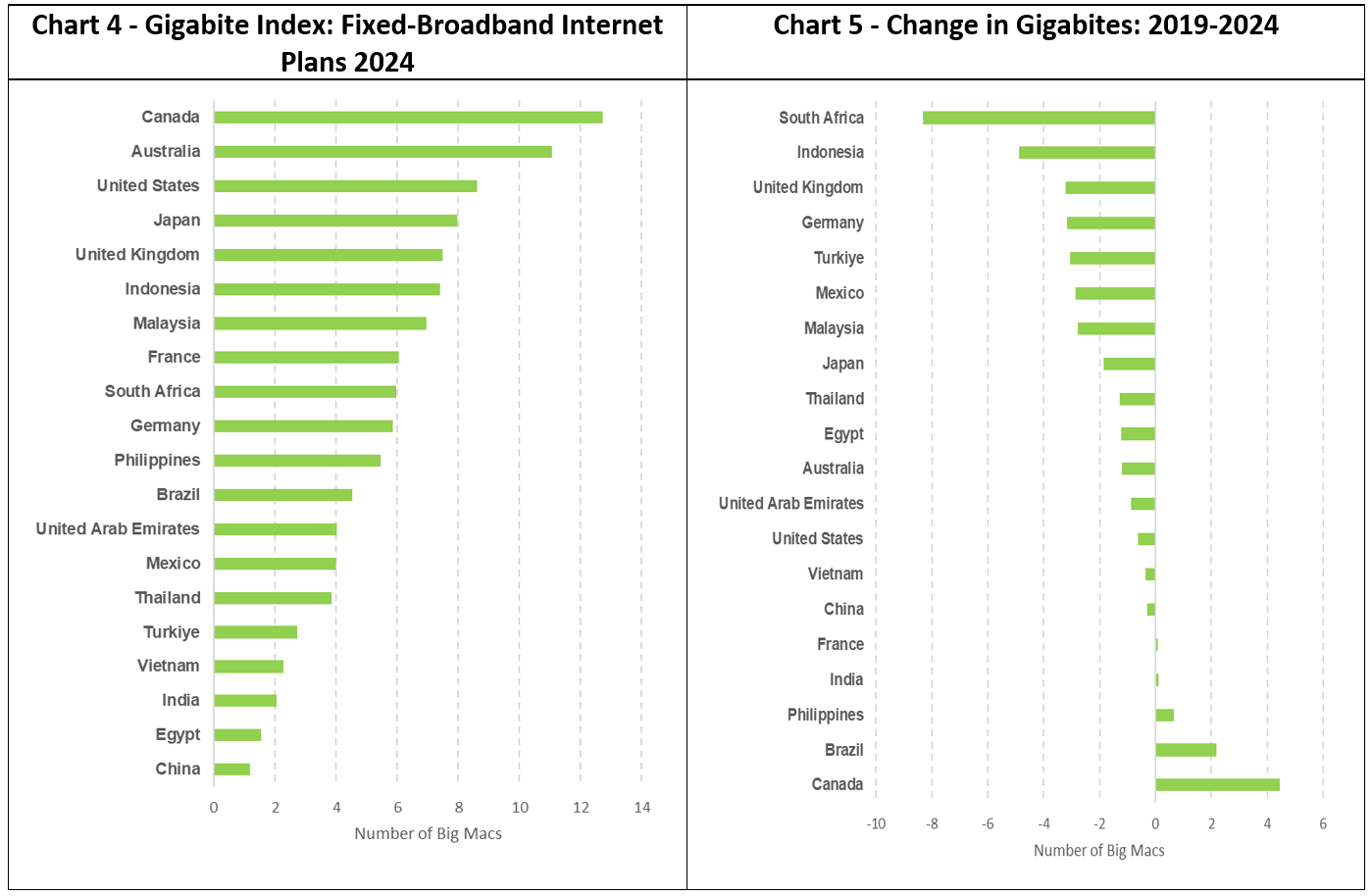

How about fixed-broadband Internet basket plans (charts four and five)? This time, Canada leads on the trade-off cost. There, fixed-broadband customers require a hefty 12.7 Big Macs for a monthly subscription. China has by far the lowest required trade-off at just 1.2 Big Macs. Developed Europe is again relatively cheaper than North America.

And since 2019, relative prices have fallen against those of our standard Big Mac in all countries bar five (and two of those marginally).

Source: Huawei calculations based on data from ITU and The Economist

Maybe the Big Mac itself as a unit of exchange has become less useful since 2019? There certainly seems to have been particular consternation about the perceived increase in the cost of this beloved hamburger in the last year or so.

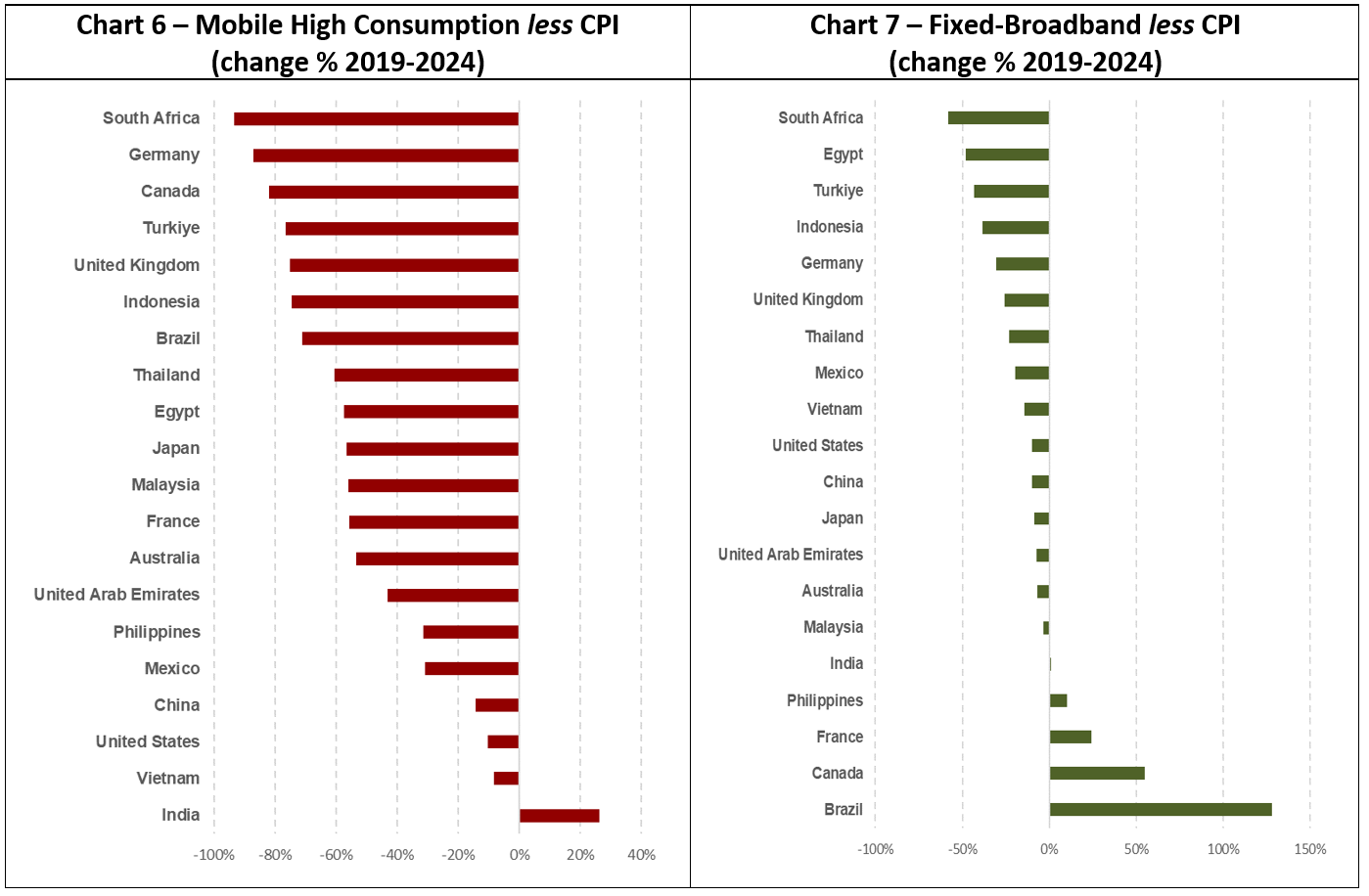

Let’s instead take the entire basket of goods and services in a country as our benchmark for the overall price rise since 2019, as represented by each country’s consumer price index (CPI). In charts six and seven, I take the change in mobile and fixed connectivity plans and subtract the overall change in CPI in each country (a net positive value would therefore suggest telecommunication price rises had exceeded those of the CPI in that country).

A similar finding holds. For high-consumption mobile data and voice plans, price falls and even some rises were far-outpaced by increases in the general price level since 2019. In South Africa, the CPI rose by 28% overall, but comparable mobile plans fell by a huge 65%. Only in India did mobile plans increase more than the CPI, according to ITU and IMF data.

While the gap in Fixed-Broadband plans is less pronounced than those for mobile, most of the countries in chart seven experienced absolute price decreases, creating large gaps with uniform increases in the CPI. Despite perceptions to the contrary in my home country (the United Kingdom) this resonates with the findings of Ofcom of stable or even falling real prices in telecommunications services for households in an environment of mounting cost-of-living pressures.

Source: Huawei calculations based on data from ITU and IMF

In summary, you’re getting a lot more internet for the price of a Big Mac than you did in 2019. Moreover, standardised prices (as estimated by the ITU) for telecommunication services have actually fallen in real-terms in many countries, which has helped cushion the cost of living crisis. Whether or not these positive trends will continue is open to debate.

Learn more about Huawei's telco solutions.

Disclaimer: Any views and/or opinions expressed in this post by individual authors or contributors are their personal views and/or opinions and do not necessarily reflect the views and/or opinions of Huawei Technologies.

Leave a Comment