Transformation Towards Autonomously Managed Communications, Cloud & AI Infrastructure

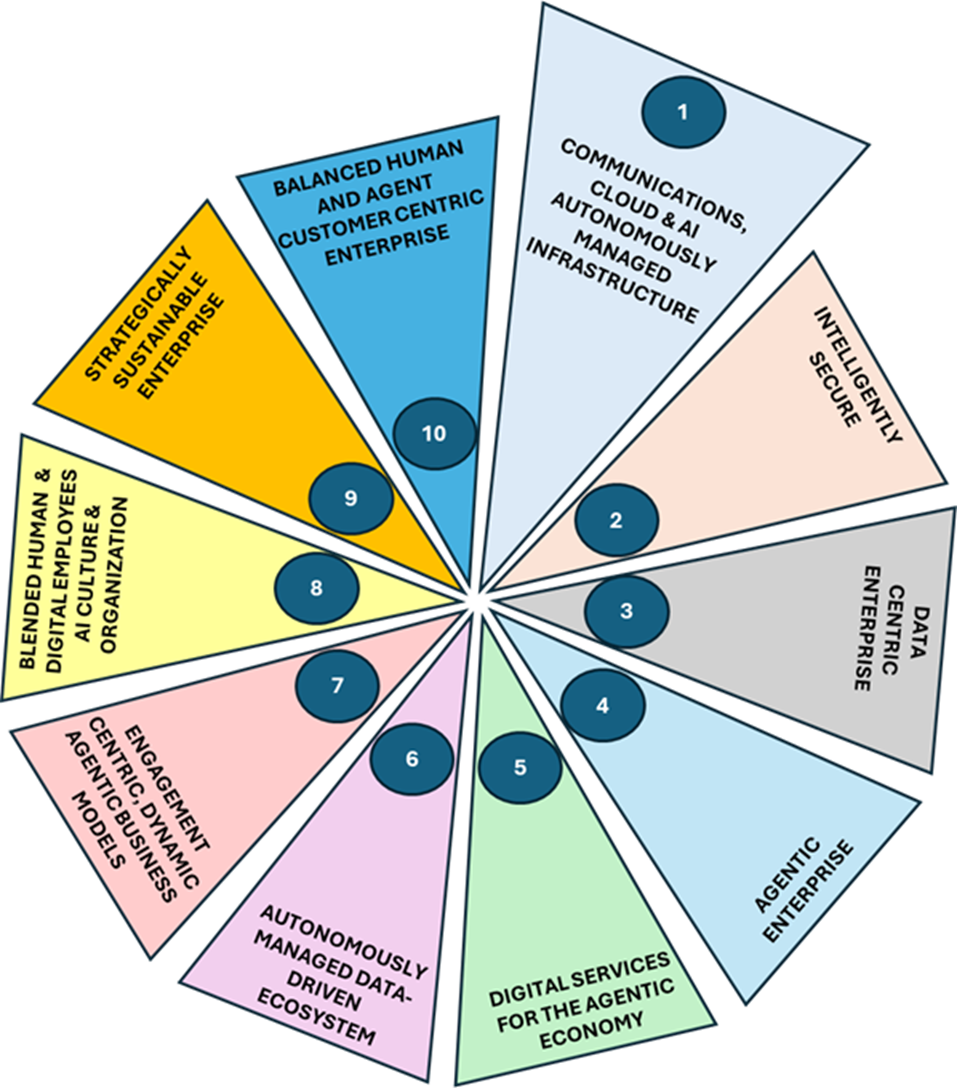

In earlier articles I shared some thoughts about the emergence of the Intelligent Telco - a telco that is at the forefront of the emerging Agentic economy that positions itself as a balanced communications, cloud and AI player. The10 Transformation journeys to become the Intelligent Telco is summarized in the graphic below.

This article explores some aspects of the first journey of this transformation. Journey 1 focuses on how the telco infrastructure evolves towards autonomously-managed,ommunications, cloud and AI infrastructure.

Image Source: Martin Creaner

A change initiated by technology and accelerated by politics!

For the past 120 years, much of how the telco has organised itself, hired staff, allocated budget and defined its self-worth has been around the quality and scale of its communications infrastructure! While this continues to be true, the definition & nature of communications infrastructure has changed to such an extent that it would be unrecognizable to an engineer from even 30 years ago. The lines have been blurred across technologies, with fixed, mobile, wifi, and satellite network elements all needing to be considered. Even more disruptively, the telco infrastructure has shifted into the cloud – to a greater or lesser extent - while the telco cloud itself, and its AI capabilities, are evolving into a critical part of the commercial proposition the telco is offering to customers.

In Transforming the Telco I spent a good portion of time talking about the telco’s journey towards cloudified, autonomously managed fixed and mobile infrastructure. It’s encouraging to see that this cloudification has happened to a greater or lesser degree over the past 5 years. The cloudification of the management infrastructure is almost complete, although there are still a few elements that sit in proprietary boxes - getting fewer by the day. The cloudification of the network itself is more fragmented. Core infrastructure virtualization has happened in many telcos (estimated to currently be as high as 90%), but virtualization of the RAN is less common with a few outliers such as Rakuten representing less than 10% of cell sites globally. And this cloud migration is happening on a number of different pathways, depending on the specific circumstances of each given telco.

The progress in AI-driven autonomous management of the network has been similarly impressive – albeit with plenty of pain! The TMForum has produced a Level 0 to Level 5 scale of autonomy that has become the defacto standard for much of the industry, and over the past couple of years, we have seen multiple examples of level 4 autonomous networks. These networks use a combination of Agents and Copilots to create ‘digital employees’ – a phrase that could well become hugely controversial over the coming years.

And infrastructure complexity continues to grow. Telcos are no longer entirely fixed/mobile-centric in their thinking. In recent years, satellite infrastructure has progressed rapidly. Starlink (among other smaller players) has thrown a rock into the communications pond, arguing that LEO satellite can play an important role in the communications ecosystem. Starlink has delivered a hugely impressive network of over 7,000 satellites offering good quality broadband at competitive prices across the globe. Competitors such as OneWeb, Kuiper, GuoWang are also investing heavily and over the coming 5 years I expect to see a new ‘space-race’ to see who can best align excellence in satellite communications technology with excellence in business models.

Finally, geopolitics is having a direct impact on how the resurgence of the Telco Cloud offering. The demise of globalization has led to a new lease of life for the telco cloud & AI business opportunity. As enterprises and governments look for cloud solutions that would help meet their economic protectionist needs and cyber-security needs, they have begun to turn to national telco champions as a trusted partner to provide the government and industry with sovereign AI and cloud.

The cloudified telco & the telco cloud

While the two concepts of Cloudified Telco and Telco Cloud are related they need to be thought of as distinct as they are being driven by very different dynamics.

The emergence of the cloudified telco

As mentioned earlier, over the past five years, there has been an inexorable evolution towards the Cloudified Telco (i.e. shifting the telco network and management systems into the cloud). The key decisions telcos have taken have revolved around how quickly they move into the cloud, and whether both the network and the management systems need to be in the cloud.

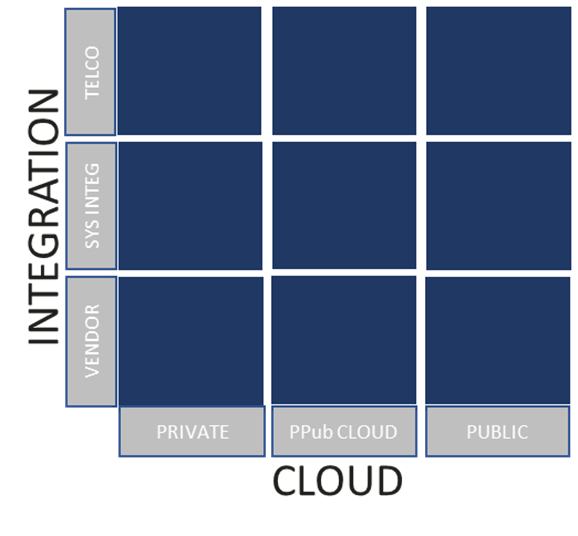

The model that best describes the different approaches telcos have taken to become cloudified, asks two questions:

- What sort of cloud are you migrating into: is it an entirely private cloud; or a private space within a public cloud; or fully into the public cloud. Any one of these might be viable, and it will often depend on what portion of the network or management systems are under consideration.

- Who will do the integration/porting into the cloud. This is relevant as it speaks to the skills and competency strategy of the telco. The three most likely integrators are: the vendors of the cloud virtual functions; an independent systems integrator; or the telco itself.

Image source: Martin Creaner

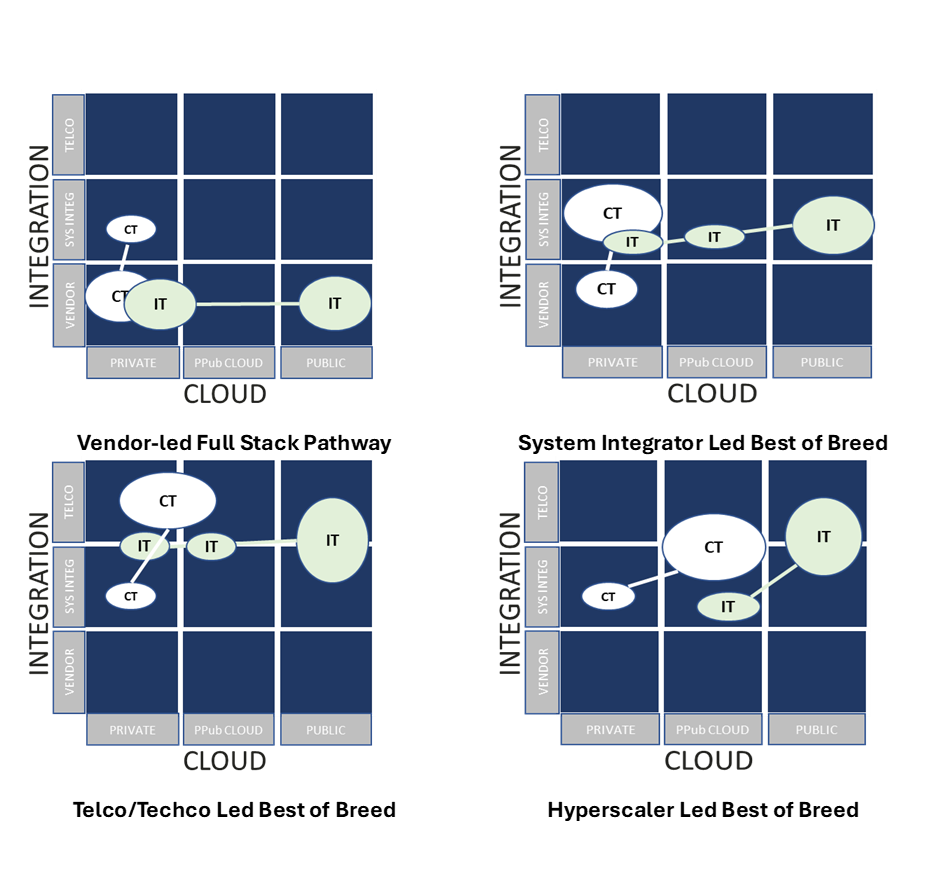

Analyzing this over the past few years I have observed 4 distinct approaches or pathways that have been adopted.

Pathway 1: The Vendor-led Full Stack

In this pathway the telco uses the vendor(s) one-stop shop for hardware, platforms & applications to deploy siloed vertical solutions with vertical integration. Both network technology and IT management systems are hosted in the private cloud with some IT ultimately shifting to public cloud. This has allowed telcos to kick off their journey in partnership with their traditional vendor, gradually shifting management infrastructure into the private/public cloud or even into the full public cloud, while keeping all of the cloudified network infrastructure in the private cloud.

Pathway 2: The System Integrator Led Best of Breed

In this pathway the telco has used systems integrators and vendors to leverage COTS hardware and integrate multi-vendor virtualized functions. As with the previous pathway, this has allowed the telco to keep the communications infrastructure in a private cloud while allowing the IT to shift towards the public cloud. This option increases the implementation risk to a certain extent, but this is balanced by the benefit of allowing the telco to move away from dependence on a single vendor.

Pathway 3: The Telco/Techco Led Best of Breed

In this scenario, the telco/techco builds the platform and integrates their own cloudified functions using components from multiple vendors. They run communications functions in a private cloud with some less sensitive functions run in private/public cloud. Management systems are migrated to the public cloud with some IT remaining in private and private/public cloud. This pathway has been the preferred choice for telcos who have already invested in maintaining a substantial internal resource base with cloud competency, and who see themselves eventually evolving into a Techco.

Pathway 4: Hyperscaler Led Best of Breed

In this scenario the telco runs communications in Private/Public cloud (with the option of shifting some to full public cloud). This solution is led by the hyperscaler which is providing the cloud and supported by systems integrators and specialist COTS vendors. IT runs in public cloud and some private/public cloud.

Pathway 1 is a favored option for those who want to minimize integration challenges, take quicker advantage of vendor improvements and an easier automation pathway. It does of course result in continued lock-in to traditional vendors. Pathway 2 keeps the telcos options open regarding use of innovative 3rd parties. There is however a non-trivial risk surrounding difficulties in integration between vendors, as well as potentially swapping vendor lock-in with SI dependency. Pathway 3 allows the telco to adopt an open platform approach, and theoretically strengthens the telco’s ability to offer differentiated services leveraging the deep understanding the telco will have of its own capabilities. However, as mentioned above it requires the telco to have multi-vendor integration skills and deep cloud expertise in-house. In this pathway, it can be difficult to contain the costs of integration/operation. Pathway 4 is the most open option, theoretically allowing a multi-vendor approach right from the get go. It also allows the telco to fully leverage the hyperscaler partnership and deep cloud integration. However, it places the telco fully dependent on the hyperscaler and exposes the telco to the risk that the hyperscaler has currently little experience on the minutiae of telco environments. Telcos need to take-on this journey with their eyes fully open, fully aware of the potential pitfalls.

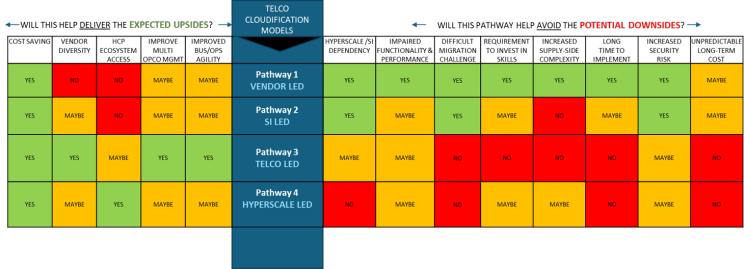

Choosing the right Cloudification Pathway

As mentioned earlier, cloudification is a work-in-progress for many telcos. Some aspects are close to completion while others have a long way to go. In this on-going journey, the telco needs to continue to question their choices and continue to explore the best pathway for them that balances between upsides and downsides!

The UPSIDES of Cloudification

- INITIAL COST SAVING: Consensus is that in the short to medium term there will be substantial CAPEX and OPEX savings through Cloudification

- INCREASED VENDOR DIVERSITY: Cloudification (unless provided entirely by traditional vendor) will open up the opportunity for increased vendor diversity and break the stranglehold of the existing vendors.

- ACCESS TO HYPERSCALERS ECOSYSTEMS: There is a belief that as telcos cloudify in partnership with (in part or in whole) with hyperscalers that they will gain the added benefit of being able to plug into the extensive developer ecosystem of the hyperscalers, and that this in turn will create new network monetization opportunities that were previously unavailable to the telco.

- MULTI-OPCO MANAGEMENT CONSISTENCY: For Telco groups there has always been a huge challenge in gaining economies of scale from their network technologies as different OpCo’s would all tend to be on different versions of technology (or even different vendors or generations). Shifting infrastructure into the cloud allows much more uniform network implementations across a full multi-opco Telco.

- BUSINESS AND OPERATIONS AGILITY: There is a belief (possibly mistaken) that cloudification of the network will finally enable real elastic provision of cloud and communications as a single offering which will open up new service opportunities.

The Potential DOWNSIDES of Cloudification

- HYPERSCALE or SI DEPENDENCY:- A fear that telcos will simply swap vendor lock-in for Hyperscaler/SI lock-in

- FUNCTIONALITY & PERFORMANCE: Telcos continue to worry that cloudified functionality will be inferior to traditional functionality, and that generic servers will not be able to deliver equivalent performance to dedicated ASICs/FPGAs. They also worry about achieving five 9’s reliability. Some of these fears are being assuaged by practical experience, but they still linger.

- MIGRATION: There are concerns that the costs of migration from current environment to a fully cloud native environment will be orders of magnitude higer than expected, cancelling out the operational efficiency improvements.

- SKILLS: Concern that telco will not be able to maintain sufficient skills to manage and operate in a cloudified environment.

- COMPLEXITY OF ECOSYSTEM: Perversely, while telcos often yearn to move away from vendor dependence, they also fear the complexity of a multi-vendor environment.

- SECURITY: The threat landscape in a cloudified environment is less well understood and this creates a barrier to enty for telcos considering this move.

- LONG-TERM COSTS: There is a concern that, while in the growth phase cloud is likely to offer cost efficiencies, that in the long term the costs of using the cloud may prove to be financially unattractive.

When I examine each of the 4 possible pathways in the context of these upsides and downsides I come to the conclusion set out below. I’m sure each reader may hold a different view on the strengths and weaknesses of each pathway.

The resurgence of the Telco Cloud – in the guise of Sovereign Cloud & AI

At one time, telcos had the ambition of being the leading cloud services provider for enterprises (and even consumers) in their sphere of influence. This led to strong investment by telcos in building out their own datacenters and developing cloud or hybrid-cloud value propositions for their customers. As AWS, Azure and others grew into the massive cloud hyperscalers they currently are, it became obvious that the economies of scale were unassailable. Telcos have always thought of themselves as large companies, but it soon became apparent that they were orders of magnitude smaller than the hyperscalers in terms of ability to invest, global reach and attractiveness to developers. In a globalized world, the largest platforms attract business and investment at a speed and scale that the smaller, regional players cannot hope to match. AWS, GCP and Azure quickly gobbled up the bulk of the enterprise cloud opportunities, with ultracompetitive pricing, global reach, and constantly improving technology. Telco investors lost faith in the prospects of telco cloud and withdrew to a large extent from the cloud market.

But nothing lasts forever! At the start of this decade we started witnessing the slow dissolution of globalization, and one of the unexpected side-effects has been a resurgence in the telco cloud business opportunity – this time wearing the cloak of ‘sovereignty’. As enterprises and governments looked for AI and cloud solutions that would help meet their economic protectionist needs, cyber-security needs, and geopolitical independence needs, they began to turn to national telco champions as a trusted partner that could meet these needs. Furthermore, as AI advances and we can see the crucial importance of Agentic AI, the industry is beginning to appreciate that nations not only need sovereign cloud but also need ‘Sovereign AI/Agentic Platforms’. These platforms, sitting on a secure national Sovereign Cloud, operate the multiple agents users will need, and securely holds the hugely sensitive personal data that consumers and enterprises will grant to those agents.

Over recent years, telcos have succeeded in significantly expanding their sovereign cloud offerings. These sovereign telco offerings in most cases have necessarily involved partnership with non-national hyperscalers, but importantly for the telco, has shifted the balance of power. The emerging sovereign offerings have allowed them to have more control and to hold a somewhat peer relationship with hyperscalers, rather than act simply as a reseller.

Original article published on LinkedIn

About the Author

Martin Creaner, Director General, World Broadband Association

Martin is seen as one of the leading strategic thinkers in the global communications industry. Previously, Martin was the President & CEO of the TM Forum, as well as holding executive positions with Motorola and British Telecom.

Martin is a recongnized thought-leader on Digital Transformation and the trends of the emerging digital eonomy. Hist most recent book Transforming the Telco explains the opportunities and challenges presented by digital transformation and outlines how the Telco might navigate this difficult process.

Disclaimer: Any views and/or opinions expressed in this post by individual authors or contributors are their personal views and/or opinions and do not necessarily reflect the views and/or opinions of Huawei Technologies.

Leave a Comment